Is it complicated for you to grasp your company’s bookkeeping?

No worries, today we will go through Bookkeeping For Small Business Hidden Secrets Medium Matt Oliver in-depth, which will enable you to comprehend accounting’s hidden details.

Bookkeeping For Small Business Accounting Hidden Secrets Medium Matt Oliver

You are not aware if your small company is successful enough since you’ve never bothered to keep track of the figures?

You should change your accounting system quickly if you have an internet business and still use paper and pencil bookkeeping.

And company accounting is indeed among the most crucial duties for any online company, but it’s tough to achieve without a solid financial foundation.

In this article, we will go over some fundamental accounting concepts so that you may establish a successful business and handle your dropshipping store’s finances as professionally as possible.

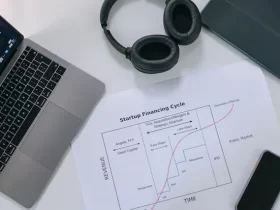

What is the cause of a company’s accounting?

If you do not have accountancy management of your resale company, it does not matter how often sales you create in your web store; everything may not go as smoothly as you expect.

Because sales or cash payments are not better indications of a business’s state, you must have a financial image of the critical aspects of your organization. That is why you must maintain your company’s accounts in order.

Small Business Accounting Principles

When starting a small business, you must understand all accounting principles to determine your company’s financial capabilities. That is, understanding how much you make, miss, how you spend and use your money, etc.

You must understand financial accounts to guide your company in the proper direction. So, in the segments below, we will discuss and answer issues concerning small company accounting.

Accounting Secrets for Small Businesses

All sorts of businesses require logical and rational bookkeeping. The fundamentals of accounting are the first aspect you should learn, and we will go over a few of them below.

Bookkeeping

Any financial summary can use it as a source of data. A business’s or an individual’s financial actions are recorded in books. According to journalist Matt Oliver, “the purpose of accounting is to collect and summarise financial activities in a consumable way that offers financial data about a company or individual.”The majority of businesses keep track of their finances using ledgers, business applications, or a combination of the two.

Balance Sheet

“A balance sheet is a representation of a company’s economic status at a point it time, generally the month-end or the year. “You can establish the present financial wellbeing of a corporation by examining and evaluating this financial report,” explains Matt Oliver.

The Balance Sheet lists all of your investments, including total assets like saving accounts and other financial assets like loan collections. However, it also displays the sum of present liabilities, such as debts to repay. Profit from assets and investments are included in equity.

The Balance Sheet’s sections and structure are based on and comply with Generally Accepted Accounting Principles. It is the guideline to follow for the production of accounting records.

Capital

It is the money given by the businessmen in capital and expenditures. It also applies to excess money after ownership deposits that lead to profits.

Expenses

They are the actions that remove money from the situation. Loans for your company, monthly expenditures such as wages, power, and resource bills, renting and other costs, money out are all examples of expenditures.

Income

The percentage of growth in the manager’s equity as sales and other company operational functions refers to income.

Expenses

It is the inverse of income; for instance, the amount by which the owner’s equity decreases.

Select an Accounting Method

You must pick the appropriate accounting method for your company before submitting your initial tax form.

Accounting on a Cash Basis

It is a straightforward accounting system that keeps track of money as it comes in and expenses as they go out.

Accounting based on accruals

When cash is “won” instead of “received,” this approach is used to calculate it. Even though a customer agrees on a substantial agreement, the system will consider the money won even if the client has not yet paid. It is a much more complicated strategy, but it enables the company to project a long-term reputation.

It is helpful for SMEs when alerting investors and making immediate scaling choices. We suggest discussing with an accountant to analyze which strategy is most appropriate for your small company.

What Records Do You Need to Keep?

What financial documents do you need to keep track of your company’s progress? Keep records of the documents that support the income, spending, exclusions, and credits reported on your tax filings. This material might include the following:

- Earnings

- Debit cards and financial records

- Accounts

- Checks canceled

- Bills

- Transaction receipts

- Bank accounts or your accountant’s balance sheets

- Tax records from the past

- W2 and 1099 tax filings

- Any other documentation backs up a claim of earnings, loss, or credits on your tax filing

Not only should such records be retained till they are handed to the debt collector, but they should also be kept after that. Usually, information should be preserved for a minimum of three years, while some procedures may need records to be kept for up to five years.

Checklist for Accounting And control

Below is a suggested checklist for keeping valuable books in good condition.

Accounting Projects for the Week

- All payments should enter into your accounting system or a Google spreadsheet.

- Characterize your transactions since your tax form will classify them accordingly.

- To maintain everything in control, file or scan receipts.

Accounting Activities for the Month

- Rationalize your financial balances to shield yourself from unexpected income or costs.

- Invoices should be prepared and sent as soon as possible.

- Pay suppliers and other payments as soon as possible to prevent paying the interest.

- To manage payables and maintain cash flow, examine the due amount.

- Examine your current financial status. “Do I have sufficient money to keep buying and selling?” you must question yourself. See how much money you have in the account and how much you anticipate getting shortly.

The essential thing to remember is to set up a time to handle your company’s finances. Having proper records can also make things easier when filing your company’s monthly and quarterly taxable income.

Tips for bookkeeping

1. Separate your individual and company finances

Co-mingling expenditures may appear to be a good plan at first. But, it may rapidly become a burden for your small business. You should open a new bank account right away. Opening up a business bank account might also help your company. A corporate bank account can assist you in the following ways:

- Follow your company’s budget.

- Arrange your accounting files

- Organize your company’s finances.

2. Keep detailed records

Accounting information, such as company invoices, payments, and costs, may help or hurt your company’s books. The personal finances of your business may harm if you fail to maintain correct records. If you choose to preserve paper documents, put them in a reliable and confidential location. Also, use alternative labeling and sorting tactics to keep your print accounting data organized.

If you don’t like the feel of paper documents, go for the electronic version. For protection, store digital backups of accounting data on your devices. Try retaining both a paper and a digitized version of your financial statements to guarantee that they are protected. You’ll have a duplicate in case something goes wrong.

3. Create a list of deadlines and set reminders

It is complex to keep track of the schedule and miss a deadline as a professional business person. Set up reminders to prevent skipping deadlines. Also, to ensure that your books are ready for the pay period. To guarantee you don’t forget any approaching deadlines, add company tax return deadlines and other alerts to your schedule.

You may even monitor significant dates and make notifications for yourself using a computerized calendar. Prepare ahead for your company’s taxes. You’ll be able to pay your tax obligations on time and avoid fines for missing deadlines.

4. Put your books in the forefront of your mind

You have a thousand things to do as a small businessman. It is easy to put your records on the back burner to concentrate on operating your business. Manage your books if you want to run your business on the path to achieving and maintaining your financials in order.

5. Accounting Secrets for Small Businesses

Keeping track of your finances takes discipline and preparation. These two foundations will make your job easier and help you to save time & expenses. In addition to this, grasping some areas of basic finance is necessary to ensure the survival and good operating of your company.

Bookkeeping for Small Businesses: Are Your Books Current?

Conclusion

A thorough understanding of your accounts will enable you to make wise choices for your SME or small company. You may outsource your accountancy to an outside specialist if you have no time to study and have other priorities.

However, knowing the terminology and operations functionality is necessary to evaluate whether your company is on the correct route. We expect that this article will assist you in the management of your small business.

Leave a Reply