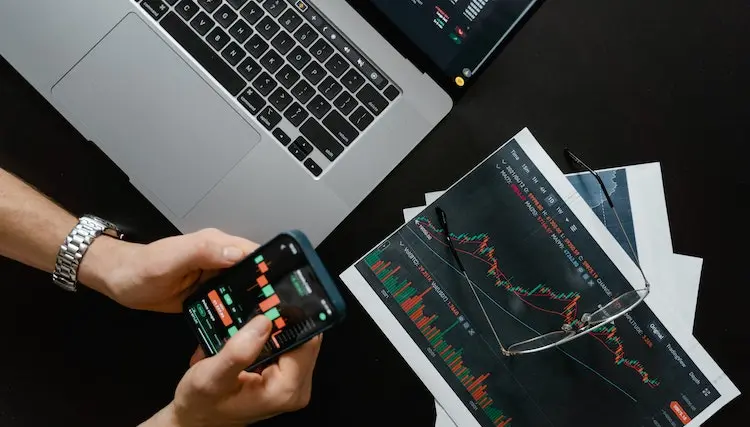

In today’s fast-paced trading environment, speed is an essential factor for traders looking to gain a competitive edge. Low-latency trading networks have emerged as a crucial tool for achieving this goal. These networks are designed to minimize the time it takes for data to travel from one point to another, allowing traders to execute trades with lightning-fast speed.

The advantages of low-latency trading networks are numerous, from reducing the risk of slippage to improving overall trading performance.

In this blog post, we’ll explore the need for speed in trading and how low-latency networks can help traders stay ahead of the curve. So, join us as we delve into the world of high-speed trading and discover how low-latency networks can help you achieve your trading goals.

Gain a Competitive Edge

With trade execution times measured in microseconds, these low latency trading networks like Beeks dedicated servers offer a distinct advantage over traditional trading platforms.

The ability to make quick and informed decisions is crucial in the fast-paced world of finance. Low latency networks allow traders to access market data and execute trades with minimal delay, improving the chances of capturing market opportunities and avoiding losses.

By leveraging the speed and reliability of low-latency networks, traders can stay ahead of the competition and maximize their profitability. For financial institutions looking to remain competitive in today’s markets, low-latency trading networks are essential tools that can help them stay ahead of their peers and meet the demands of their clients.

Increase Trading Efficiency

Low latency networks allow traders to receive market data and execute trades faster than traditional networks, which can give them an edge in the market. This can be particularly important in high-frequency trading, where even small differences in speed can make a significant impact on profits.

By reducing the time it takes to receive and process market data, low-latency networks can help traders make more informed decisions and execute trades with greater precision and accuracy. In addition, low latency networks can support greater volumes of trades, allowing traders to take advantage of more opportunities in the market.

Improve Order Execution Times

Improving order execution times is crucial for firms engaged in high-frequency trading, where even the slightest delay can result in significant losses. Low-latency trading networks have revolutionized the financial industry, providing traders with the ability to execute trades at lightning-fast speeds. By reducing the distance between their servers and the exchange, firms can achieve sub-millisecond round-trip times and gain a competitive edge in the market. Not only does this lead to faster order execution and improved trading performance, but it also enables traders to take advantage of market opportunities that may only exist for a brief period of time.

Reduce Price Slippage

Price slippage occurs when there is a delay between the time an order is placed and the time it is executed, resulting in a difference between the expected price and the actual price at which the transaction is executed.

This can be particularly problematic for high-frequency trading strategies, where even small price movements can have a significant impact on profitability. By reducing latency, low-latency trading networks can help to minimize price slippage and ensure that trades are executed at the desired price, increasing overall trading efficiency and profitability.

Enhance Overall Performance

With faster network speeds and lower latency, traders can execute trades more quickly and accurately, which can lead to increased profits and better risk management. In the high-stakes world of financial trading, even a few milliseconds can make a significant difference in the outcome of a trade.

By minimizing latency, traders can take advantage of market opportunities as soon as they arise, allowing them to stay ahead of the competition and achieve better results.

In addition, low latency networks can help to reduce the risk of errors or delays, which can lead to costly mistakes and lost opportunities. For these reasons and more, low-latency trading networks have become an essential tool for traders looking to maximize their performance and gain a competitive edge in the market.

Conclusion

Low-latency trading networks have become essential for financial institutions that want to execute trades with speed and accuracy. The advantages of low latency networks are numerous, including reduced slippage, improved execution times, and increased profitability.

As financial markets continue to evolve, low-latency networks will become even more important in keeping up with the demands of modern trading. Financial institutions must continue to prioritize the development and implementation of low-latency networks to stay competitive in the ever-changing world of finance.