Financial well-being isn’t merely about earning money; it’s about making informed decisions, setting goals, and strategically planning for the future. Let’s explore the significance of life finances and the strategic approach needed to secure a stable and fulfilling financial future.

The Basics of Life Finances

Life finances encompass every aspect of one’s financial journey, from budgeting and saving to investing and planning for major life events. It involves managing income, expenses, debts, and assets, all while aligning financial decisions with personal goals and aspirations. To embark on this journey, individuals must first gain an understanding of their financial landscape.

Budgeting as a Compass

Budgeting acts as a financial compass, helping individuals allocate resources efficiently and avoid unnecessary detours. By tracking income, categorizing expenses, and identifying areas for saving, a budget serves as a practical tool for maintaining financial discipline. It ensures that money is allocated to meet current needs while also contributing to future financial goals.

Emergency Preparedness

Life is unpredictable, and financial storms can arise unexpectedly. A strategic financial plan includes building an emergency fund to weather these storms. This fund is a safety net that provides financial stability in the face of emergencies. It prevents individuals from derailing their financial journey when faced with unforeseen challenges.

Debt Management

Debt can be a significant obstacle. A strategic approach involves managing and, where possible, eliminating debt efficiently. Prioritizing high-interest debts, exploring debt consolidation options, and adopting a disciplined repayment strategy can pave the way for a smoother financial journey.

Investing for the Future

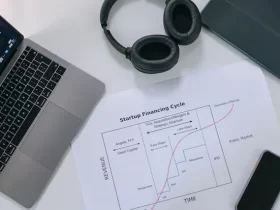

Investing is a critical component of strategic financial planning. It involves deploying resources in vehicles that have the potential to grow over time, such as stocks, bonds, real estate, and retirement accounts. Discussing long-term plans and goals with a financial planner Houston or locally to you can ensure you make the most of your finances and options. Through strategic asset allocation and diversification, individuals can gain the power of compounding and build wealth over the long term.

Retirement Planning

Retirement planning is a key destination in the journey of life finances. A strategic approach involves determining retirement goals, estimating expenses, and identifying suitable investment vehicles. By starting early and regularly contributing to retirement accounts, individuals can build a nest egg that provides financial security and peace of mind in their golden years.

Adaptability and Flexibility

Life is dynamic, and financial strategies must adapt to changing circumstances. This requires a level of flexibility in financial planning. Whether it’s adjusting goals, reallocating investments, or reassessing spending habits, a strategic approach involves being responsive to life changes and making informed adjustments to the financial plan.

Financial Education

A strategic approach to life finances includes an ongoing commitment to financial education. Understanding investment options, staying informed about economic trends, and continuously improving financial literacy empower individuals to make informed decisions and navigate the evolving financial landscape effectively.

In Conclusion

Strategic financial planning is not just about accumulating wealth; it’s about crafting a financial journey with purpose and intention. In this journey, each financial decision serves as a stepping stone, bringing individuals closer to their goals and aspirations. It’s a journey that requires patience, discipline, and a strategic mindset. With each informed choice, individuals chart a course toward financial well-being, ensuring that their life finances align with the fulfilling and prosperous life they envision.