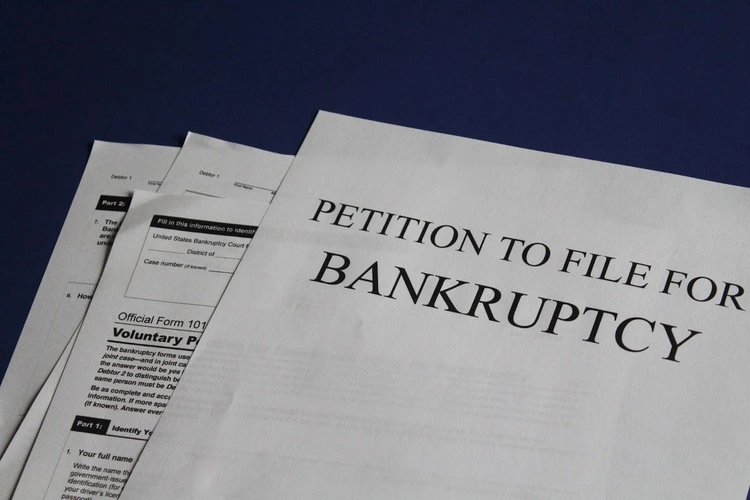

Bankruptcy is meant to provide relief and a new start to those experiencing financial issues. Different people file for bankruptcy for varying reasons. It could be due to loss of employment or a significant income decline, making dealing with bills and debts difficult. Sudden, expensive medical issues not covered by health insurance can leave you struggling with medical debt, forcing you into filing for bankruptcy.

Separation and divorce can be costly, especially when one partner is drowning in a substantial debt, which may become unmanageable, pushing them into seeking bankruptcy protection. Others may go bankrupt due to addictions or being windowed. While filing for bankruptcy offers you a fresh start, knowing everything about it can help you make informed choices. This article outlines six things you need to know before filing for bankruptcy.

- Pre-bankruptcy credit counseling

When drowning in debt, you may think bankruptcy is your only way out. However, credit counseling can help you determine if that’s what you need. It’s meant to make you better understand whether you can regain strong financial footing minus bankruptcy. A professional counselor from an approved, reputable credit counseling company, such as Doyle Salewski, will look at your expenses and income, discuss options, and assist you in creating a personal budget. This ensures you’ve explored all possible alternatives before filing for bankruptcy.

- When to declare bankruptcy

If you’ve exhausted all alternatives that can help meet your financial obligations and still can’t repay your debts, it could be time to declare bankruptcy. If you’re behind in mortgage payments, have substantial debts you can’t repay, and are at risk of foreclosure, or your creditors are at your neck, you may have to file for bankruptcy. This often eliminates or minimizes your debts, keeps your creditors at bay, and saves your home.

- Bankruptcy qualifications for individuals

Individuals have two primary bankruptcy types, including:

- Chapter 7: This type of bankruptcy is meant for those who cannot afford to pay their debt, specifically unsecured. To be eligible, your earnings must be less than your family’s median income in your state. Where your earnings are too high to be considered, try taking a means test where a court trustee evaluates your reasonable expenses and income. Failing the test means you have sufficient income to cater to your bills and, as such, aren’t eligible for Chapter 7 bankruptcy. If the means test determines that your income is insufficient, you can leverage the Chapter 7 debt relief

- Chapter 13: If you aren’t eligible for Chapter 7, Chapter 13 or the wage earners’ bankruptcy is your next option. You’re eligible for Chapter 13 provided total unsecured and secured debts combined are less than $2,750,000 as of the bankruptcy relief filing date

Personal loans, credit card debt, medical bills and lawsuit obligations, and judgments from contracts or leases qualify for these two chapters. Chapter 13 wipes out debts, a retirement plan, and divorce (minus support payments).

- Benefits of filing for bankruptcy

It keeps creditors away: Bankruptcy offers permanent and temporary relief or breaks from debt collectors. An automatic stay keeps from attempting to get money from you as long as the bankruptcy is pending and offers temporary foreclosure, car repossession, and eviction protection. If bankruptcy discharges your debt, you get permanent relief, and as such, creditors can no longer bother you

- It offers emotional and mental relief: Financial stress and multiple creditors on your neck can significantly impact your mental and emotional health. Declaring bankruptcy gives you the much need relief

- It safeguards your wages: Income earned after filing for bankruptcy isn’t considered the bankruptcy estate’s property. This means your wages can’t be used to repay creditors for discharged debts

- Bankruptcy filing consequences

Before filing for bankruptcy, considering its consequences can help determine if it’s the right move. They include:

- Reduced credit access: Declaring bankruptcy reduces your chances of getting new credit. This means if you’re eligible for any loans, they’ll most likely be high-interest with lowered credit limits

- Decreased credit score: Credit score assesses your debt repayment ability. Filing for bankruptcy hits your credit card. Since bankruptcy stays on your credit for ten or seven years, your score will continue being impacted the entire time

- Possible asset loss: While declaring bankruptcy may delay car repossession and home foreclosure, losing them later is possible. Chapter 13 bankruptcy allows you to keep your properties as you repay your debt on a debt plan. However, defaulting may risk those assets. In addition, Chapter 7 bankruptcy requires the liquidation of non-exempt assets to repay creditors

- Tax refund loss: You can get tax refunds when in bankruptcy. Nevertheless, the refunds may be directed toward repaying your federal tax debt

- Bankruptcy filing alternative

Instead of filing for bankruptcy, look for options to help lower your obligations without severe credit history effects. You can negotiate with your creditors and agree on a manageable repayment plan. If mortgage repayments are a problem, consider other options like loan modification and forbearance. If you have an IRS debt, check if you qualify for an offer in compromise. Alternatively, the IRS can give you a payment plan if you cannot clear all your tax obligations at once.

Endnote

Declaring bankruptcy gives you debt relief and enables you to start afresh. However, you should learn everything to know before filing for bankruptcy.